Internal Sources of Finance

- An internal source of finance is money that comes from within a business such as owners capital, retained profit and money generated from selling assets

- An external source of finance is money that is introduced into the business from outside such as a loan or share capital

Internal sources of finance

Owner’s capital: personal savings

- Personal savings are a key source of funds when a business starts up

- Owners may introduce their savings or another lump sum, e.g. money received following a redundancy

- Owners may invest more as the business grows or if there is a specific need, e.g. a short-term cash flow problem

Retained profit

- The profit that has been generated in previous years and not distributed to owners is reinvested back into the business

- This is a cheap source of finance, as it does not involve borrowing and associated interest and arrangement fees

- The opportunity cost of investing the money back into the business is that shareholders do not receive extra profit for their investment

Sale of assets

- Selling business assets which are no longer required (e.g. machinery, land, buildings) generates finance

- A sale and leaseback arrangement may be made if a business wants to continue to use an asset but needs cash

- The business sells an asset (most likely a building) for which it receives cash

- The business then rents the premises from the new owners

- E.g. In early 2023, Sainsbury’s announced that it was in talks to sell the prime retail property for £500 million, which will then be leased back to them by the new owners, LXi Reit

Sale of stock

- Stock may be sold at reduced prices in order to raise additional finance

- This reduces the opportunity cost and storage cost of high inventory levels

- It must be done carefully to avoid disappointing customers if stock runs low

- E.g. A clothing retail business holds a January sale to get rid of old stock and make space for new Spring stock

Managing working capital

- A business can also generate additional finance internally by managing its working capital more effectively

- They can negotiate extended payment terms with suppliers

- They can incentivise customers to pay more promptly for credit purchases

Evaluating the use of Internal Finance

Advantages |

Disadvantages |

|

|

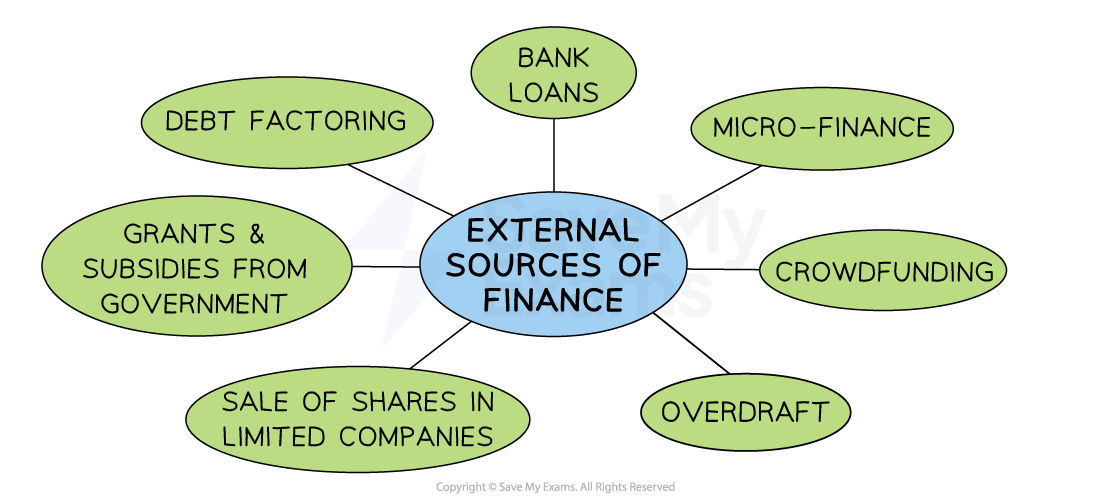

External sources of finance include borrowing, such as loans and bank overdrafts, share capital, grants and contemporary methods such as crowdfunding

External sources of finance include borrowing, such as loans and bank overdrafts, share capital, grants and contemporary methods such as crowdfunding