An Introduction to Price Elasticity of Demand

- Price elasticity of demand (PED) measures how responsive demand for a product is to a change in price

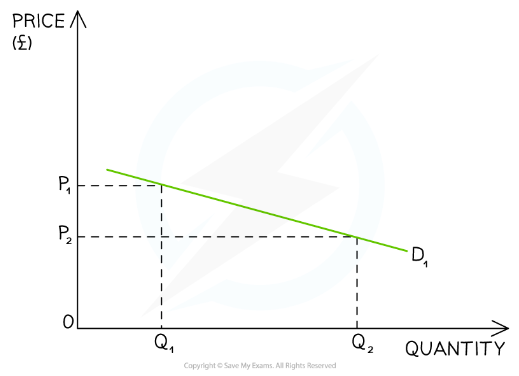

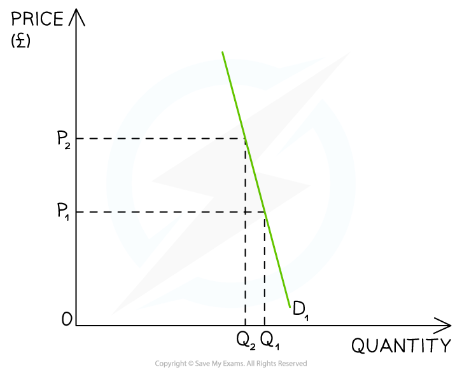

- In most cases an increase in price leads to a fall in demand for a product

- Similarly a fall in price leads to an increase in demand for a product

- Price elasticity of demand answers the question of by how much demand changes?

- Price elastic demand is where the volume of a product's sales changes by a greater percentage than the change in price

- E.g. A 10% increase in price leads to a 20% decrease in the volume of sales

- Price inelastic demand is where the volume of a product's sales changes by a smaller percentage than the change in price

- E.g. A 10% increase in price leads to a 5% decrease in the volume of sales

- Price elastic demand is where the volume of a product's sales changes by a greater percentage than the change in price

Calculation of PED

- Price elasticity of demand is calculated using the formula

- PED will always be negative due to the inverse relationship between price and quantity

- If the price goes up the quantity demanded goes down

- If the price goes down the quantity demanded goes up

- The numerical value of PED indicates the responsiveness of a change in quantity demanded to a change in price

Interpretation of PED Values

Numerical Value |

Explanation |

Examples |

|

> 1 ELASTIC |

|

|

|

Between 0 & 1 INELASTIC |

|

|