Risk, Ownership and Limited Liability

- When an entrepreneur starts a business, they need to consider what kind of legal structure they want for their business

- Their decision will depend upon a range of factors

- The level of personal risk they are willing to take

- The advice they receive

- The level of privacy they would prefer in running the business

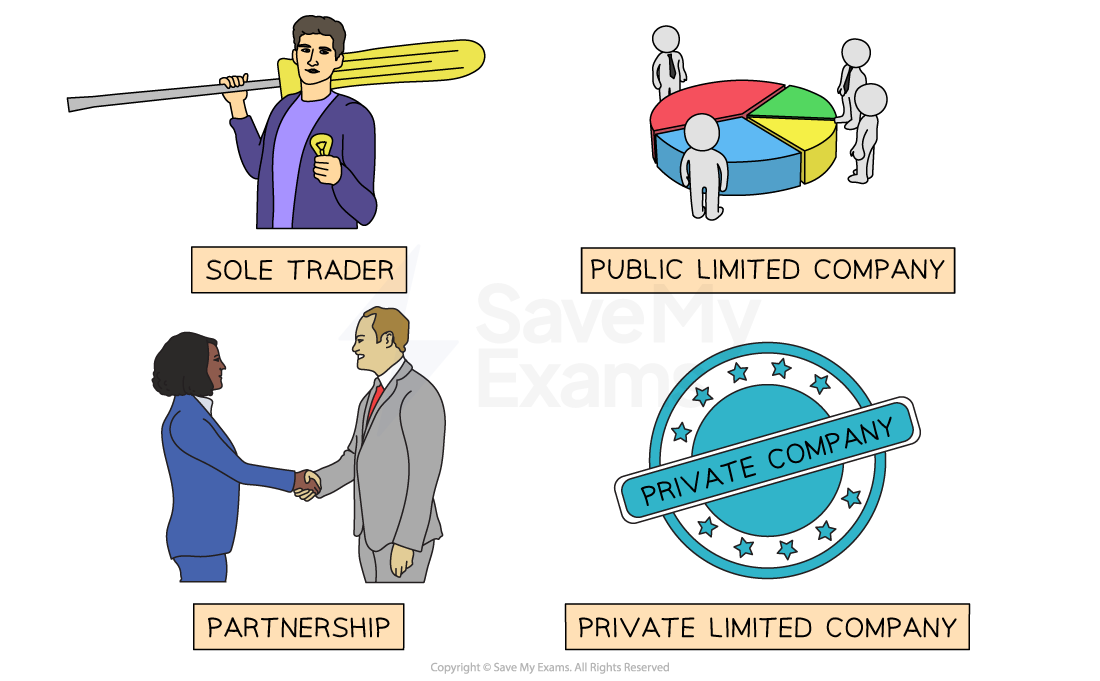

Diagram: Types of Business Ownership

Businesses can operate as sole traders, partnerships or companies

- Sole traders and partnerships are unlimited liability businesses

- They are easy to set up and start trading

- Information about their financial performance does not need to be shared outside of the business

- Private limited companies and public limited companies offer the protection of limited liability to their owners (shareholders

- Setting up a company is a legal process that takes time to arrange

- Information about financial performance needs to be shared with Companies House and is available for scrutiny by any interested third party

A Comparison of Unlimited & Limited Liability

Liability |

Description |

Implications |

|

Unlimited liability |

|

|

Limited liability |

|

|