Introduction to External Sources of Finance

- An external source of finance is money that is introduced into the business from outside

- External finance is used when a business cannot fulfil its needs with internal sources of finance

The main Sources of External Finance

Overdrafts |

Trade Credit |

Loans |

|

|

|

Share Capital |

Venture Capital |

Crowdfunding |

|

|

|

-

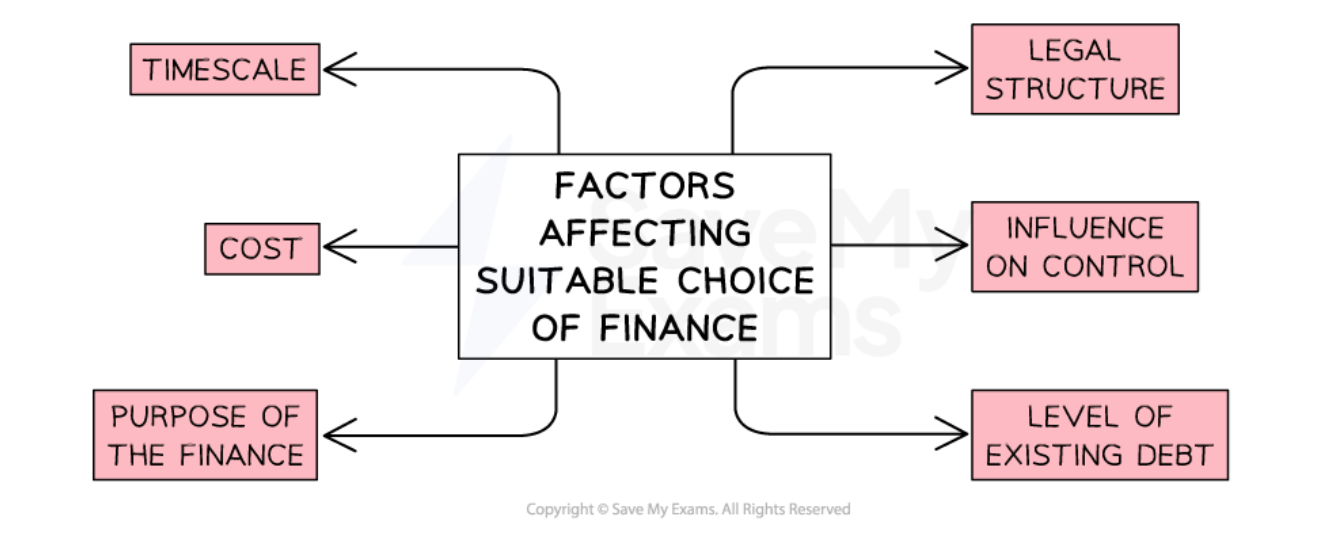

The implications of the different types of external finance need to be carefully considered

-

Interest and fees to arrange finance can vary significantly between financial providers

-

The percentage of company ownership required in exchange for finance depends on how much risk investors are willing to take

-

The length of time allowed to repay borrowings or achieve investment targets also varies

-