Introduction to cash flow Forecasts

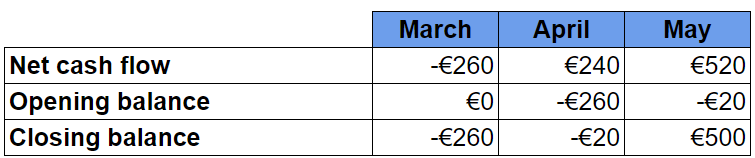

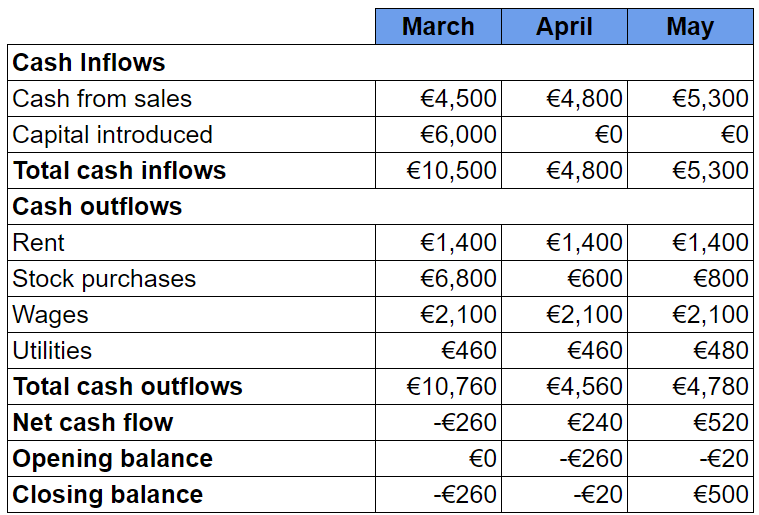

- A cash flow forecast is a prediction of the anticipated cash inflows and cash outflows, usually for a six to twelve month period

- A business plan should include a cash flow forecast

- Business owners can identify its financial needs

- Lenders such as banks can determine whether loans are capable of being repaid

- Business owners can identify its financial needs

The Uses & Limitations of Cash Flow Forecasts

Uses |

Limitations |

|

|