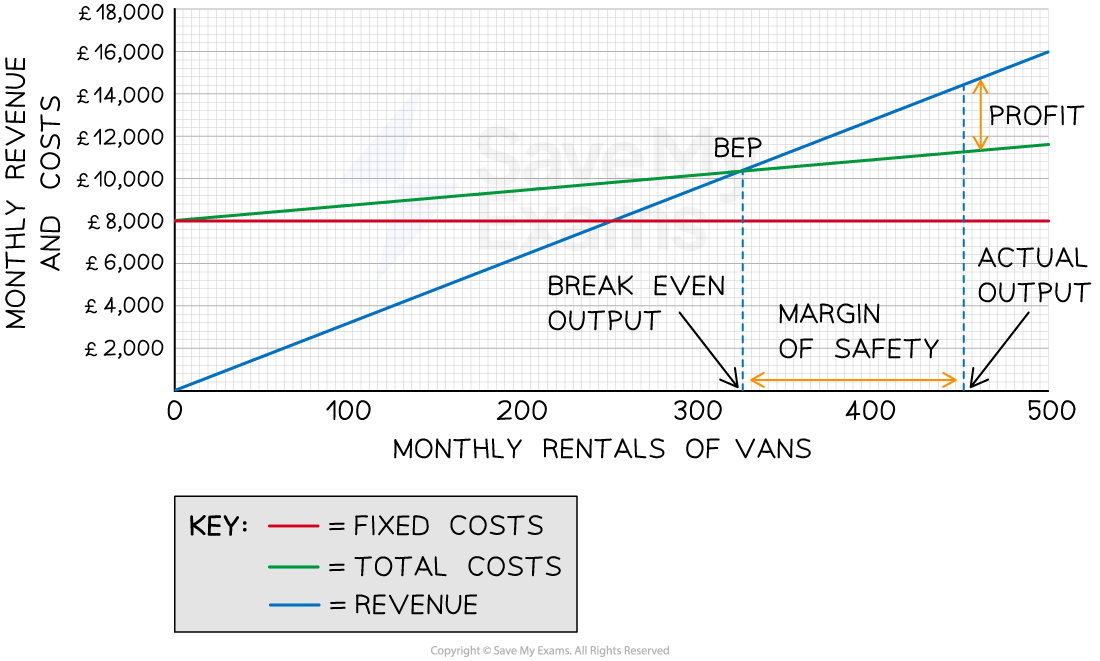

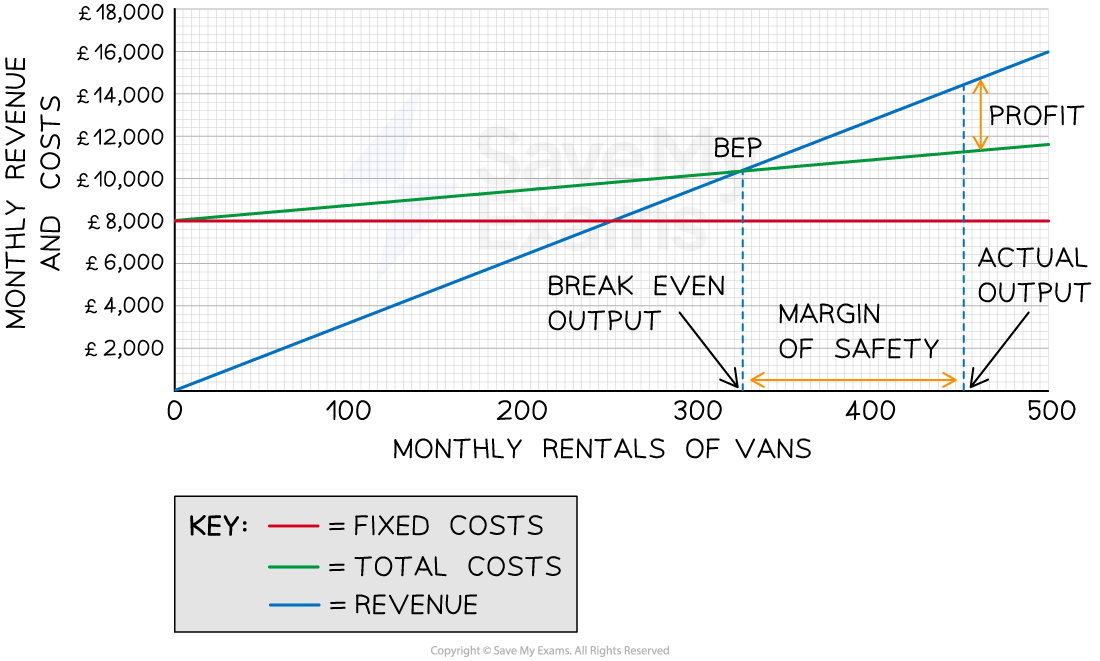

- The elements can be identified in the break-even chart below

- The selling price is £32 per unit

- Variable costs are £7.60 per unit

- Fixed costs are £8,000

Diagram: Break-even Chart with Key Elements

The break-even chart shows the break-even point, profit at a given level of output and the margin of safety

Diagram analysis

- Fixed costs do not change as output increases

- Fixed costs are £8,000 and these do not change whether the business produces 0 units or 500 units

- It is therefore represented by a horizontal line at £8,000 for all levels of output

- Total costs are made up of fixed and variable costs

Fixed, Variable and Total Costs at Different Levels of Output

| Units |

0 |

100 |

200 |

300 |

400 |

500 |

Variable costs (£)

|

0

|

760 |

1,520 |

2,280 |

3,040 |

3,800 |

Fixed costs (£)

|

8,000 |

8,000 |

8,000 |

8,000 |

8,000 |

8,000 |

Total costs (£)

|

8,000 |

8,760 |

9,520 |

10,280 |

11,040 |

11,800 |

-

- At 0 units of output, total costs are made up exclusively of fixed costs

- At 500 units, the total costs are £11,800

format('truetype')%3Bfont-weight%3Anormal%3Bfont-style%3Anormal%3B%7D%3C%2Fstyle%3E%3C%2Fdefs%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2218.5%22%20y%3D%2216%22%3ETotal%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2269.5%22%20y%3D%2216%22%3EVariable%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22123.5%22%20y%3D%2216%22%3ECosts%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22156.5%22%20y%3D%2216%22%3E%3D%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22187.5%22%20y%3D%2216%22%3EUnits%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22216.5%22%20y%3D%2216%22%3E%26%23xD7%3B%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22257.5%22%20y%3D%2216%22%3EVariable%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22307.5%22%20y%3D%2216%22%3ECost%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22339.5%22%20y%3D%2216%22%3Eper%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22369.5%22%20y%3D%2216%22%3EUnit%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%228.5%22%20y%3D%2259%22%3E%3D%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2234.5%22%20y%3D%2259%22%3E500%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2259.5%22%20y%3D%2259%22%3E%26%23xD7%3B%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2277.5%22%20y%3D%2259%22%3E%26%23xA3%3B%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2288.5%22%20y%3D%2259%22%3E7%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2295.5%22%20y%3D%2259%22%3E.%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22107.5%22%20y%3D%2259%22%3E60%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%228.5%22%20y%3D%22102%22%3E%3D%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2227.5%22%20y%3D%22102%22%3E%26%23xA3%3B%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2238.5%22%20y%3D%22102%22%3E3%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2245.5%22%20y%3D%22102%22%3E%2C%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2261.5%22%20y%3D%22102%22%3E800%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2218.5%22%20y%3D%22145%22%3ETotal%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2260.5%22%20y%3D%22145%22%3ECosts%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2293.5%22%20y%3D%22145%22%3E%3D%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22125.5%22%20y%3D%22145%22%3EFixed%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22169.5%22%20y%3D%22145%22%3ECosts%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22201.5%22%20y%3D%22145%22%3E%2B%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22231.5%22%20y%3D%22145%22%3ETotal%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22282.5%22%20y%3D%22145%22%3EVariable%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22336.5%22%20y%3D%22145%22%3ECosts%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%228.5%22%20y%3D%22188%22%3E%3D%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2227.5%22%20y%3D%22188%22%3E%26%23xA3%3B%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2238.5%22%20y%3D%22188%22%3E8%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2245.5%22%20y%3D%22188%22%3E%2C%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2261.5%22%20y%3D%22188%22%3E000%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2286.5%22%20y%3D%22188%22%3E%2B%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22104.5%22%20y%3D%22188%22%3E%26%23xA3%3B%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22115.5%22%20y%3D%22188%22%3E3%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22122.5%22%20y%3D%22188%22%3E%2C%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%22138.5%22%20y%3D%22188%22%3E800%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%228.5%22%20y%3D%22231%22%3E%3D%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2227.5%22%20y%3D%22231%22%3E%26%23xA3%3B%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2243.5%22%20y%3D%22231%22%3E11%3C%2Ftext%3E%3Ctext%20font-family%3D%22math17fc2f01a1f847f9077daadcbe9%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2254.5%22%20y%3D%22231%22%3E%2C%3C%2Ftext%3E%3Ctext%20font-family%3D%22Arial%22%20font-size%3D%2216%22%20text-anchor%3D%22middle%22%20x%3D%2270.5%22%20y%3D%22231%22%3E800%3C%2Ftext%3E%3C%2Fsvg%3E)

-

- In the chart, the total costs line slopes upwards because total variable costs increase as output increases

- Revenue is the quantity sold x selling price

Revenue at Different Levels of Output

| Units |

0 |

100 |

200 |

300 |

400 |

500 |

Revenue (£)

|

0 |

3,200 |

6,400 |

9,600 |

12,800 |

16,000 |

- The revenue line also slopes upwards

- At 0 units of output, the revenue is £0

- At 500 units the total revenue equates to £16,000

- Revenue increases with output

- The line will slope more steeply than the total costs and will cross the total costs line at some point

- The point at which the total costs and the revenue lines cross is the break-even point

- The break-even level of output is 328 units

- The margin of safety can be identified as the difference on the x-axis between the actual level of output (in this case, 450 units) and the break-even point

- The margin of safety is 450 - 328 = 122 units

- The profit made at a specific level of output can be identified as the space between the revenue and total costs lines

- In this instance, the profit made at 450 units of output is £14,400 - £11,420 = £2,980