Using the Income Statement (AQA GCSE Business)

Revision Note

Author

Lisa EadesExpertise

Business Content Creator

Profit Margins

Profit margins measure how successfully a business converts revenue into profit

Profitability can be measured in two ways:

The gross profit margin

The proportion of revenue that is converted into gross profit

It is calculated using the formula

Worked Example

Head to Toe Wellbeing’s revenue in 2022 was $124,653. Its gross profit was $105,731

Calculate Head to Toe Wellbeing Ltd’s gross profit margin in 2022. [2 marks]

Step 1: Substitute the values into the formula

[1]

Step 2: Multiply the outcome by 100 to find the percentage

[1 mark]

84.82% of Head to Toe Wellbeing’s revenue was converted into gross profit during 2022

The net profit margin

The proportion of revenue that is converted into net profit

It is calculated using the formula

Worked Example

Head to Toe Wellbeing’s revenue in 2022 was $124,653. Its net profit was $65,864

Calculate Head to Toe Wellbeing Ltd’s net profit margin in 2022. [2 marks]

Step 1: Substitute the values into the formula

[1]

Step 2: Multiply the outcome by 100 to find the percentage

[1]

In 2022, 52.84% of Head to Toe Wellbeing’s revenue was converted into profit before interest and tax

Profit margins are expressed as percentages

This allows comparison of business performance over time and also comparisons with other businesses

Stakeholders and profitability

Several stakeholders are interested in profitability

Investors look carefully at profitability when deciding which business to invest in

The higher the level of profitability, the higher their rewards are likely to be

Directors and managers consider profitability when assessing business success and determining future objectives and strategy

Employees may consider profitability as justification for requesting higher wages or better working conditions

Using the Income Statement to Judge Performance

Income statements inform managers whether the business is making a profit or loss

They allow managers to:

Compare performance to previous years

Make future forecasts

Make comparisons with competitors

Finance managers are able to interrogate the data in order to make decisions, make beneficial changes or set new strategic objectives

Case Study

Chillie's Cafe

Chillie's Cafe sells cold drinks during the summer season in central Berlin

Its two best-selling products are bubble tea and smoothies

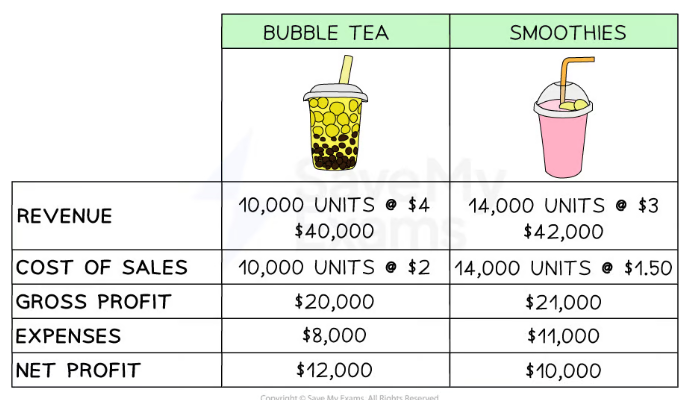

Diagram: Extracts from Chillie's Cafe's Income Statement

The income statement contains a range of information that can be used to make decisions and judge performance

Although Chillie's sells bubble tea drinks at a higher price, smoothies are more profitable for the business

Fewer bubble tea drinks than smoothies are sold, so revenue is lower

The cost of sales of bubble tea are higher than those for smoothies

Questions to Consider when Analysing the Income Statement

|

|

|

|

|

|

Exam Tip

You will not be given the formulas in the exam, so you must ensure that you revise them thoroughly. You are usually asked to state the formula before applying it to a calculation.

You've read 0 of your 0 free revision notes

Get unlimited access

to absolutely everything:

- Downloadable PDFs

- Unlimited Revision Notes

- Topic Questions

- Past Papers

- Model Answers

- Videos (Maths and Science)

Did this page help you?