Regulation of firms that pollute is likely to be a problem because it

allows firms to use price signals

creates unintended consequences

fills information gaps for businesses

means lower administrative costs

Did this page help you?

Regulation of firms that pollute is likely to be a problem because it

allows firms to use price signals

creates unintended consequences

fills information gaps for businesses

means lower administrative costs

Did this page help you?

Which of these is not a cause of government failure?

Unintended consequences

Lack of administration costs

Information gaps

Distortion of price signals

Did this page help you?

In which of the following contexts would the policy shown below be most likely to lead to an improvement in the allocation of resources compared to the free market output?

Flood defences

Healthcare

Petrol

Second-hand cars

Did this page help you?

What is the fall in revenue for the producer from the imposition of an ad valorem tax as shown below?

Area B

Area A+B

Area P1Q1 - P2Q2

Area P1Q1 - P3Q2

Did this page help you?

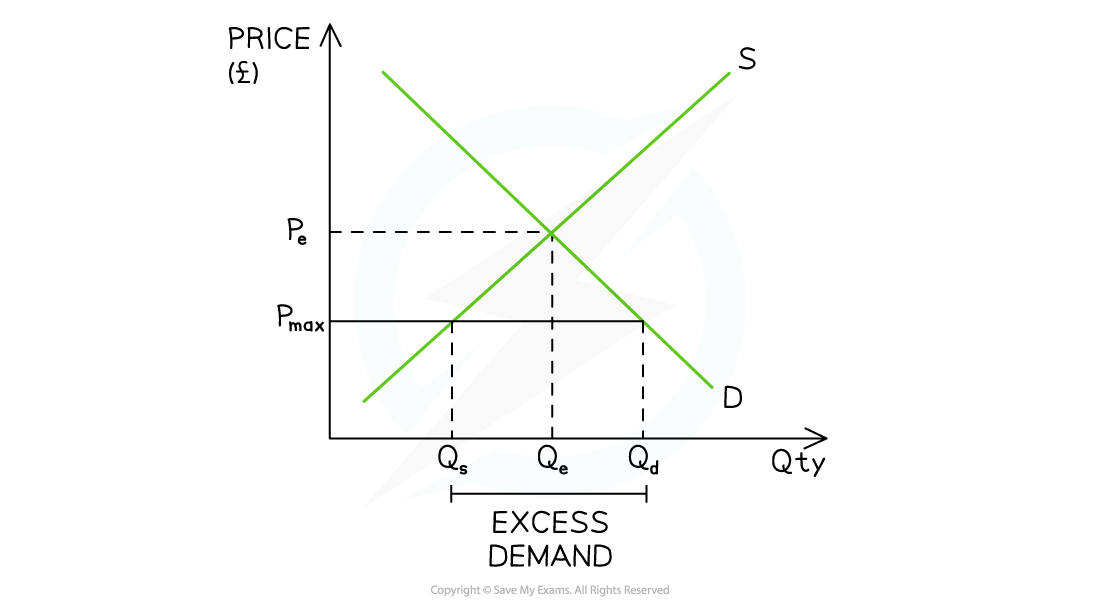

Which of the following options would be a likely consequence of a maximum price on rented accommodation

Large waiting lists for rented accommodation

More landlords entering the market to rent out their properties

A fall in supply of houses on the 'for sale' market

No effect because the maximum price is below the equilibrium price

Did this page help you?

The market for cakes is in equilibrium at a price of £1.10 and a quantity of 4,000.

VAT is imposed at 20%, leading to a new equilibrium price of £1.20 and a quantity of 3,000.

What is the total amount of government revenue from the tax?

Explain one valid reason why the government might intervene in markets

Did this page help you?

Refer Extract

Did this page help you?

Refer Extract

Evaluate the likely microeconomic and macroeconomic effects of imposing a tax on HFSS foods (25)

Did this page help you?

In 2015 a report by Public Health England recommended the imposition of a 20% tax on the sale of soft drinks that contain high levels of sugar.

Evaluate the likely microeconomic effects of such a tax (25)

Did this page help you?

Discuss the likely success of policies to reduce the consumption of single‑use plastic bags in cities such as Istanbul (12)

Did this page help you?

The EU tradable pollution permits scheme is expected to become more effective by 2020, due to recent reductions in the number of tradable pollution permits.

(Source adapted from: https://ec.europa.eu/clima/policies/ets_en)

Did this page help you?

The UK Rail Industry

Figure 1: UK government subsidy to Northern, a train operating company in Northern England

Refer to Figure 1. Explain the likely effect of the change in subsidy levels between 2017 and 2018 on rail fares.

Include a supply and demand diagram in your answer.

Did this page help you?

With reference to Extract B, explain one reason for government intervention through regulation

Extract B

Free market approach

Are free markets incompatible with good health? If the solution to every problem involves banning advertising, raising prices and restricting availability, you might easily conclude that the free market is the disease and government regulation is the cure. From

this perspective, the providers of food, alcohol and tobacco are determined to push the most unhealthy products on the public at the lowest prices. Contrary to this viewpoint, the profit motive is not unhealthy. Businesses have an obvious incentive to keep their customers alive and customers have a strong incentive to seek out healthier options. Any company that can make a scientifically sound health claim gains a competitive advantage over its rivals. Health sells. In contrast, government regulation

can lead to negative health outcomes. Markets can correct themselves long before government failures are even acknowledged. Over a million Britons, almost all of whom are smokers or ex-smokers, use e-cigarettes, as a less hazardous product than cigarettes and yet e-cigarettes face increased regulations and in many countries they are banned. It is neither consistent nor ethical to prevent smokers from switching to much safer alternatives. Efforts to regulate e-cigarettes are a far greater threat to public health than the products themselves. We argue that the interests of consumers are nearly always better advanced by the provision of accurate information and free choice than by prohibitions and regulations. The government policy of small but steady tax rises on tobacco and ever-larger warning labels is becoming less effective and leads to unintended consequences.

(Source: adapted from http://www.iea.org.uk/blog/free-market-solutions-in-health-

should-be-allowed-to-flourish, Christopher Snowdon, 11th July 2013)

Did this page help you?