Depreciation (Cambridge (CIE) IGCSE Accounting)

Revision Note

Author

Dan FinlayExpertise

Maths Lead

Introduction to Depreciation

What is depreciation?

Depreciation is applied to non-current assets to represent the reduction in their value

Depreciation is the financial measure of how the value of an asset decreases over time

The value of a non-current asset depreciates due to:

Wear and tear of the asset

The asset becoming outdated or obsolete

The reduction in the expected useful lifetime of the asset

The asset being used up or depleted

Depreciation is an expense that accounts for the estimated loss in value of an asset during a given period

It is an expense that does not involve spending money

It is used to spread the cost of the assets over their expected useful life

You need to know three methods to calculate depreciation

Straight-line method

Reducing balance method

Revaluation method

The accounting principle of consistency states that when a business chooses a method of depreciation for a type of non-current asset, it must use that method each year unless there is a valid reason to change to a different method

Different methods can be used for different types of non-current assets

Why are non-current assets depreciated?

Depreciation is used so that the business adheres to the following accounting principles:

Matching

The capital expenditure of a non-current asset is matched against the income that it has contributed to

Suppose that a business buys a vehicle for $30 000 and expects it to be useful for 8 years

The full $30 000 should not be charged as an expense straightaway

Instead, the expense should be spread out over the 8 years that it is contributing to income

Prudence

The value of the assets should not be overstated

Depreciation allows the business to report a more realistic estimation for the valuation of its assets

Is depreciation charged in the years of purchase and sale?

Different businesses will have different policies for dealing with depreciation for the year in which the asset is purchased and the year in which the asset is sold or disposed of

The business could:

Charge a full year’s worth of depreciation

Charge no depreciation

Charge a proportion of the full year’s worth of depreciation

The exam question will specify which rules should be used

Straight-Line Depreciation

What is the straight-line method of depreciation?

The straight-line method of depreciation assumes that a non-current asset loses value at a constant rate over its useful life

This means that the expense for its depreciation is the same each year

The net book value can reach $0

This is when the asset is fully depreciated

You could be given the depreciation rate as a percentage of its original value

E.g. depreciation could be charged at 20% of its original cost

Or you could be expected to calculate the depreciation using:

The number of years that the non-current asset will be used

The expected value of the non-current asset at the end of its working life

This value could be $0

The expected value is also called the residual value

This method is usually used when the asset will be equally valuable for each year of its use

For example, fixtures and fittings, equipment, etc

How do I calculate depreciation using the straight-line method?

If you are given the percentage for the depreciation

Find the percentage of the original amount

This will be the yearly depreciation charge

If you are not given the percentage

Calculate the expected loss in value during the expected life of the non-current asset

The original value minus the expected value at the end of its life

Divide the loss by the number of years it will be used

This will be the yearly depreciation charge

Exam Tip

The straight-line method is similar to simple interest calculations used in maths.

Worked Example

Abi purchases machinery for $18 000. Machinery is depreciated at 15% per annum using the straight-line method.

Calculate the net book value of the machinery after 3 years.

Answer

Calculate the yearly expense due to depreciation

15% ✕ $18 000 = $2 700

Calculate the total depreciation after 3 years

3 ✕ $2 700 = $8 100

Subtract the depreciation from the original value

$18 000 - $8 100 = $9 900

Worked Example

Taiki purchases a vehicle for $30 000. He expects to use the vehicle for 3 years, after which he estimates that it will have a value of $12 000.

Calculate the yearly expense due to the depreciation of the vehicle.

Answer

Calculate the loss in value over the 3 years

$30 000 - $12 000 = $18 000

Divide this by the number of years

$18 000 ÷ 3 = $6 000

Reducing Balance Depreciation

What is the reducing balance method of depreciation?

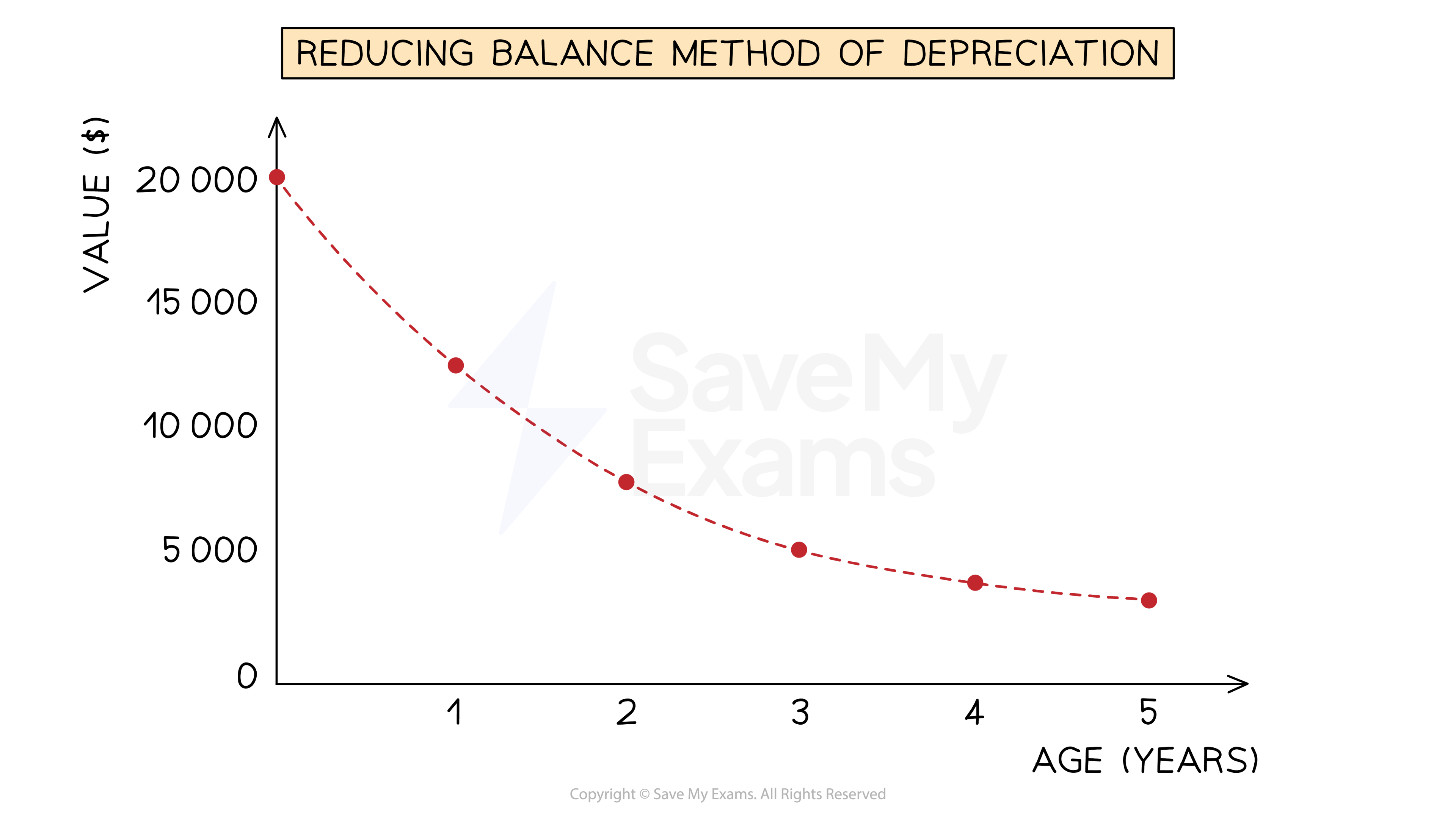

The reducing balance method of depreciation assumes that the non-current asset loses value at a rate proportional to its current value

This means that the expense for its depreciation gets smaller each year as the current value decreases

You will be told the percentage of the current value to use for depreciation

This method is usually used when a non-current asset initially loses value at a fast rate

How do I calculate depreciation using the reducing balance method?

Find the percentage of the current net book value

This will be the depreciation charge for that year

If you need to calculate the depreciation for multiple years, then calculate one year at a time

Find the depreciation charge for one year using the net book value at that start of the year

Subtract this amount from the net book value at the start of the year to find the new net book value

Find the depreciation charge for the next year using the net book value at the start of that year

Continue this process

If you just need to find the current net book value then you can use some maths skills

Subtract the percentage from 100%

Write this as a decimal

Raise this to the power of the number of years

Multiply this by the original value

Exam Tip

The reducing balance method is similar to compound interest calculations used in maths.

Amounts should always be given to the nearest dollar in exams.

Worked Example

Abi purchases a vehicle for $16 000. Machinery is depreciated at 25% per annum using the reducing balance method.

Calculate the net book value of the machinery after 3 years.

Answer

Find the depreciation charged in each year by finding the percentage of the net book value at that time.

Subtract that year’s depreciation from the net book value to find the net book value at the end of the year.

End of year | Depreciation charge | Net book value |

0 | - | $16 000 |

1 | 25% ✕ $16 000 = $4 000 | $16 000 - $4 000 = $12 000 |

2 | 25% ✕ $12 000 = $3 000 | $12 000 - $3 000 = $9 000 |

3 | 25% ✕ $9 000 = $2 250 | $9 000 - $2 250 = $6 750 |

Alternatively:

Subtract the percentage from 100%

100% - 25% = 75%

Write this as a decimal

75% = 0.75

Raise this to the power of the number of years

0.753

Multiply this by the original value

$16 000 ✕ 0.753 = $6 750

Revaluation Depreciation

What is the revaluation method of depreciation?

The revaluation method of depreciation involves performing a valuation of assets at the end of the financial year to determine the reduction in value

This method is commonly used for assets of smaller value

Such as loose tools, packing cases

How do I calculate depreciation using the revaluation method?

A revaluation of the non-current asset will be given in the question

You need to identify two numbers:

The net book value before the revaluation

The net book value after the revaluation

The depreciation charge is the value before minus the value after

Worked Example

Abi purchased fixtures and fittings for $5 000 on 1 March 2023. On 29 February 2024, at the end of the financial year, the fixtures and fittings were valued at $3 650.

Calculate the depreciation charged for the financial year ending on 29 February 2024.

Answer

Value before the revaluation is $5 000

Value after the revaluation is $3 650

Calculate the difference

$5 000 - $3 650 = $1 350

You've read 0 of your 0 free revision notes

Get unlimited access

to absolutely everything:

- Downloadable PDFs

- Unlimited Revision Notes

- Topic Questions

- Past Papers

- Model Answers

- Videos (Maths and Science)

Did this page help you?